Looking to Buy or Refinance a Home?

Apply Today With:

TIM ANDERS

|

SONYA SIMPSON

Phone:

828-650-9422

Toll Free:

866-463-8411

Blog Post

Your Debt-to-Income Ratio and Mortgages

- By Admin

- •

- 20 Oct, 2021

Do you plan to apply for a mortgage? One of the most important numbers involved in the mortgage process is your debt-to-income ratio. What is your debt-to-income ratio? What should your goals be in order to qualify for a mortgage? And how can you reach those goals? Here's what you need to know.

What Is a Debt-to-income Ratio?

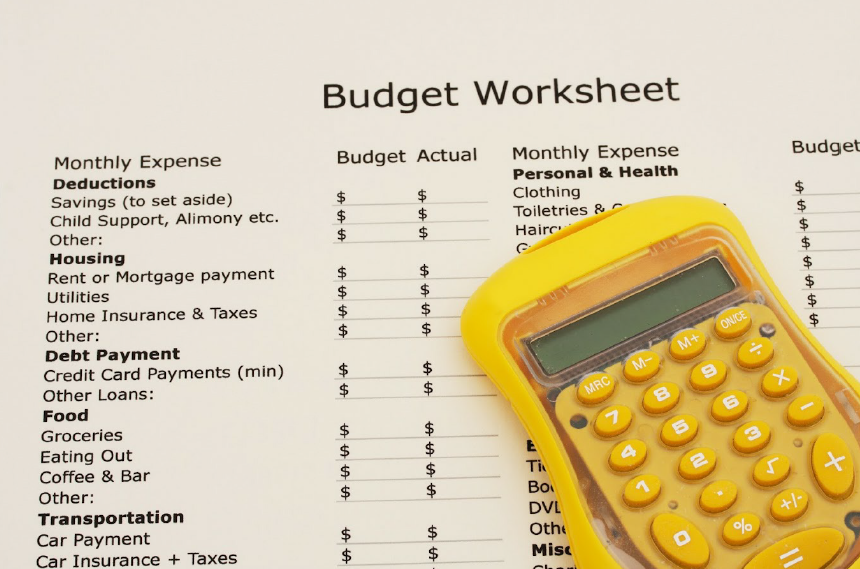

Debt-to-income ratio is the percentage of your monthly income that is currently used to pay debts. The calculation is fairly simple. You add up your monthly debt payments and then divide these by your monthly income. A person with $3,000 income each month and $500 in debts has a roughly 16% debt-to-income ratio.

However, actually doing this calculation can be tricky. If your income fluctuates, you may need to use an average over a period of several months. On the debt side of the equation, you should use mandatory minimum payments, even if you often pay extra to some debts. Generally, you would include all debts that are listed in your credit report plus any unusual ones such as alimony or child support.

What Should Your Ratio Be?

While every mortgage lender has slightly different standards, there are some guidelines for an ideal debt-to-income ratio. Most lenders consider the best ratio to be anything under 36% of your gross income. An acceptable ratio may allow you to have debt up to 43% and still get significant approval. Ratios over 50% will make qualification hard.

In addition, many lenders calculate how much of your income would be taken up by the proposed mortgage and related housing costs (like taxes). This ratio may need to be less than 28% in order to qualify for the best rates.

How Can You Reduce Your Ratio?

Do you need to reduce your ratio? If so, there are generally two ways to do it: reduce debt or raise your income. This may sound daunting, but there are some clever ways to do it. When was the last time you requested a raise or renegotiated some aspect of your compensation? If it's been a while, this is an easy way to raise income without more work.

If paying down all your debt before going house hunting is not possible, apply some other tricks to help lower your overall debt number. Consider, for instance, consolidating multiple loans into one signature loan with a lower payment than the previous minimum payments added together.

You might also analyze which debts could provide the biggest bang for the buck. If you pay off several small debts rather than one large one, you get rid of more minimum monthly payments and see a bigger drop in your ratio. And, although it may seem counterintuitive, paying more on lower interest loans can result in a smaller balance and lower payments faster than paying a higher interest loan.

Finally, look for ways to create a lump sum to apply on a one-time basis. Sell unused items, return purchases to stores, apply a bonus or tax refund, or ask for cash for the holidays. The goal is to get that ratio below the needed threshold, and a lump sum can do it quickly and easily.

Where Can You Learn More?

Want to know more about your debt-to-income ratio? Start by learning how it affects the types of mortgages you may seek and what lenders in your area expect to see. Cornerstone Residential Mortgage can help. We will work with you to get the answers you need to prepare in the best way possible for your mortgage qualification. Contact us today to speak with a mortgage pro from our office.

What Is a Debt-to-income Ratio?

Debt-to-income ratio is the percentage of your monthly income that is currently used to pay debts. The calculation is fairly simple. You add up your monthly debt payments and then divide these by your monthly income. A person with $3,000 income each month and $500 in debts has a roughly 16% debt-to-income ratio.

However, actually doing this calculation can be tricky. If your income fluctuates, you may need to use an average over a period of several months. On the debt side of the equation, you should use mandatory minimum payments, even if you often pay extra to some debts. Generally, you would include all debts that are listed in your credit report plus any unusual ones such as alimony or child support.

What Should Your Ratio Be?

While every mortgage lender has slightly different standards, there are some guidelines for an ideal debt-to-income ratio. Most lenders consider the best ratio to be anything under 36% of your gross income. An acceptable ratio may allow you to have debt up to 43% and still get significant approval. Ratios over 50% will make qualification hard.

In addition, many lenders calculate how much of your income would be taken up by the proposed mortgage and related housing costs (like taxes). This ratio may need to be less than 28% in order to qualify for the best rates.

How Can You Reduce Your Ratio?

Do you need to reduce your ratio? If so, there are generally two ways to do it: reduce debt or raise your income. This may sound daunting, but there are some clever ways to do it. When was the last time you requested a raise or renegotiated some aspect of your compensation? If it's been a while, this is an easy way to raise income without more work.

If paying down all your debt before going house hunting is not possible, apply some other tricks to help lower your overall debt number. Consider, for instance, consolidating multiple loans into one signature loan with a lower payment than the previous minimum payments added together.

You might also analyze which debts could provide the biggest bang for the buck. If you pay off several small debts rather than one large one, you get rid of more minimum monthly payments and see a bigger drop in your ratio. And, although it may seem counterintuitive, paying more on lower interest loans can result in a smaller balance and lower payments faster than paying a higher interest loan.

Finally, look for ways to create a lump sum to apply on a one-time basis. Sell unused items, return purchases to stores, apply a bonus or tax refund, or ask for cash for the holidays. The goal is to get that ratio below the needed threshold, and a lump sum can do it quickly and easily.

Where Can You Learn More?

Want to know more about your debt-to-income ratio? Start by learning how it affects the types of mortgages you may seek and what lenders in your area expect to see. Cornerstone Residential Mortgage can help. We will work with you to get the answers you need to prepare in the best way possible for your mortgage qualification. Contact us today to speak with a mortgage pro from our office.

Share

Tweet

Share

Mail

Cornerstone Residential Mortgage

MortgageMatchmakers.com

56 White Oak Road

Arden, NC 28704

Phone:

828-650-9422

Toll Free:

866-463-8411

Email Us:

ashevilledistribution@cornerstonemtg.net

Business Hours:

Monday-Friday, 9 a.m.-5 p.m.

Licensed | Business NMLS# 69551

GoPrime Privacy Policy

YP REVIEWS

Alice D. On 2/18/2021

Have used Cornerstone Residential Mortgage twice now. They helped me find great financing on a modular home and land package (permanent foundation) and then again to refinance a few years later. They got me a great interest rate both times. They are professional, wonderful communication, knowledgeable, and are genuinely present and available during the entire process. It feels like doing business with friends. I can hot recommend them highly enough!

Larry T. On 11/20/2020

If you are looking to get a home loan or re-finance then you need to call cornerstone and talk to Sonya. She and her team are the most helpful and pleasant people you will ever deal with. As a first-time buyer, I was totally intimidated by the process but they not only made it easy to understand but also made the whole process pleasant from start to finish. CALL THEM!

Pete M. On 11/06/2020

Sonya and her team are absolutely incredible! If you don't call Cornerstone first, you're wasting your time. The customer service, professionalism and respect that you receive as a customer is far beyond compare. I cannot say enough good things about these ladies. They have made my buying experience from the first call to closing day a breeze! Not to mention saving me tons of money! Thank you so much to everyone at Cornerstone Mortgage! I will recommend them to everyone I know. Don't forget to ask Sonya if she knows a fantastic realtor...Here's a hint (she does)!

Michelle P. On 08/30/2019

My husband and I highly recommend Cornerstone Residential Mortgage. Sonya, Kelly and Leslie are all great to work with! Very informative, professional and great customer service. Being a first-time home buyer, I had A LOT of questions. They would answer all my questions and stayed in contact with me during the whole process. We are now homeowners!!! Thank you to all at Cornerstone that made it happen!!!

Corrie B. On 08/08/2019

Very thankful for the whole team at Cornerstone Residential, who walked us through the purchase of our first home with ease and expertise. The whole process was stress-free and everything was well communicated. They were patient as we asked many "newbie" questions and were genuinely caring in their responses. Sonya and Leslie were awesome!! Couldn't recommend more highly.

Dorothy T. On 04/18/2019

Sonya, Kelly, and Leslie were wonderful at walking my husband and I through the entire process of purchasing our first home. We felt incredibly supported by them and their knowledge of the process as they held our hands through the whole thing. We both truly felt they all had our best interest in mind when explaining things. We felt like the entire office knew us personally with each interaction. They did an excellent job at keeping up communication and informing us of every step. They truly made the whole process way easier than what we have heard our friends experience. We have already recommended Cornerstone to several of our friends and family members. We love our new house and are so happy we had such an amazing team to help us get home! Thanks Cornerstone!!

Nigel B. On 01/31/2019

They are very professional. Whenever I called them they were always there and returned my calls if they could not. Very informative through the transaction.

Very nice people to work with. Would do business again.

Luschanee On 10/03/2018

This place was absolutely wonderful. Everyone was very friendly and treated us like family!! Buying our first home was a great experience becaue of the people here at Cornerstone Lending!

Jonathan C.

On 03.26.2018

Cornerstone guided us through the entire process. They answered questions promptly and where always available.

Amy N.

On 03.22.2018

The loan process was smooth and seamless. Sonya and her team know their stuff. I would definitely recommend Cornerstone to a friend.

Looking to Buy or Refinance a Home?

Apply Today With:

Content, including images, displayed on this website is protected by copyright laws. Downloading, republication, retransmission or reproduction of content on this website is strictly prohibited. Terms of Use

| Privacy Policy